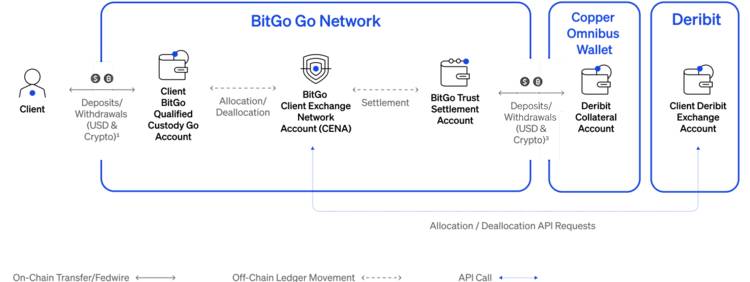

Today, BitGo Trust Company, Inc. and Copper announced the launch of a first-of-its-kind trading and off-exchange settlement solution that brings institutions unparalleled access to liquidity while maintaining the highest level of security for their assets. Clients can now trade on Deribit, the leading derivatives exchange, while their assets are secured off-exchange in qualified custody with BitGo Trust. Trades are then automatically settled via Copper’s ClearLoop and BitGo’s Go Network infrastructure.

Why does this matter?

The multi-custodial settlement model created by BitGo and Copper addresses a critical challenge that investors have historically had to face: accessing deep liquidity without compromising on security or operational agility.

BitGo and Copper have successfully bridged this gap with a solution that seamlessly integrates liquidity, qualified custody, and automated off-exchange settlement for clients. The comprehensive offering marks a significant step forward for the industry and establishes a new standard for trading.

Investors also benefit from increased capital efficiency as they can hold assets with BitGo Trust and trade with partner venues on Go Network freely without having to prefund their strategies on exchange. With the latest addition of Deribit via Copper ClearLoop to Go Network, investors will seamlessly be able to implement sophisticated trading strategies by leveraging Deribit’s robust platform for trading options and futures.

Trading without the trade offs

“Our partnership with Copper represents a fundamental shift in how investors can access exchanges. Holding assets in qualified custody and settling through ClearLoop’s tried and tested settlement process delivers what the market has been asking for—a seamless and secure way to trade. This is a testament to how committed BitGo is to setting a new standard for trading that delivers security and efficiency without compromise,” said Brett Reeves, Head of Go Network.

Ben Lorente, Strategic Alliances Director at Copper commented, "This partnership with BitGo expands our multi-custodial network within our off-exchange settlement network ClearLoop and is a significant step towards our commitment to industry interoperability of secure, reliable, and comprehensive solutions for institutional investors. This continues to ensure long-term institutional adoption of the digital asset ecosystem."

Luuk Strijers, CEO of Deribit adds, “this collaboration marks a significant step forward for the market and investors alike and we’re excited to be at the forefront of it with BitGo and Copper. The synergies between our companies will unlock new opportunities for investors and will completely change the landscape of trading.”

What’s next

As BitGo and Copper continue to push the industry forward, expect to see additional trading venues announced to our qualified custody and off-exchange settlement offering in the not-so-distant future, providing institutions with more secure, expanded access to liquidity.

Learn more about how BitGo and Copper’s partnership is setting new standards and can enhance your trading strategies and operations.

The latest

All NewsAbout BitGo

BitGo is the digital asset infrastructure company, delivering custody, wallets, staking, trading, financing, and settlement services from regulated cold storage. Since our founding in 2013, we have been focused on accelerating the transition of the financial system to a digital asset economy. With a global presence and multiple regulated entities, BitGo serves thousands of institutions, including many of the industry's top brands, exchanges, and platforms, and millions of retail investors worldwide. For more information, visit www.bitgo.com.

©2026 BitGo, Inc. (collectively with its parent, affiliates, and subsidiaries, “BitGo”). All rights reserved. BitGo Bank & Trust, National Association (“BitGo Bank & Trust”) is a national trust bank chartered and regulated by the Office of the Comptroller of the Currency (OCC). BitGo Bank & Trust is a wholly-owned subsidiary of BitGo Holdings, Inc., a Delaware corporation headquartered in Sioux Falls, South Dakota. Other BitGo entities include BitGo, Inc. and BitGo Prime LLC, each of which is a separately operated affiliate of BitGo Bank & Trust. BitGo does not offer legal, tax, accounting, or investment advisory services. The information contained herein is for informational and marketing purposes only and should not be construed as legal, tax, or investment advice. Digital assets are subject to a high degree of risk, including the possible loss of the entire principal amount invested. Past performance and illustrative examples do not guarantee future results. BitGo Holdings, Inc., BitGo Bank & Trust, BitGo, Inc. and BitGo Prime LLC are not registered broker-dealers and are not members of the Securities Investor Protection Corporation (“SIPC”) or the Financial Industry Regulatory Authority (“FINRA”). Digital assets held in custody are not guaranteed by BitGo and are not subject to the insurance protections of the Federal Deposit Insurance Corporation (“FDIC”) or SIPC. This communication contains forward-looking statements. Forward-looking statements include all statements that are not historical facts. These statements may include words such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “foreseeable,” “guidance,” “intend,” “likely,” “may,” “objectives,” “outlook,” “plan,” “potentially,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or variations of these terms and similar expressions. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. These factors include but are not limited to those described under “Risk Factors” in BitGo Holdings, Inc.’s registration statement on Form S-1, as amended, relating to the initial public offering. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in the registration statement. Although BitGo believes that the expectations reflected in its forward-looking statements are reasonable, it cannot guarantee future results. BitGo undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.