Settle with trusted partners

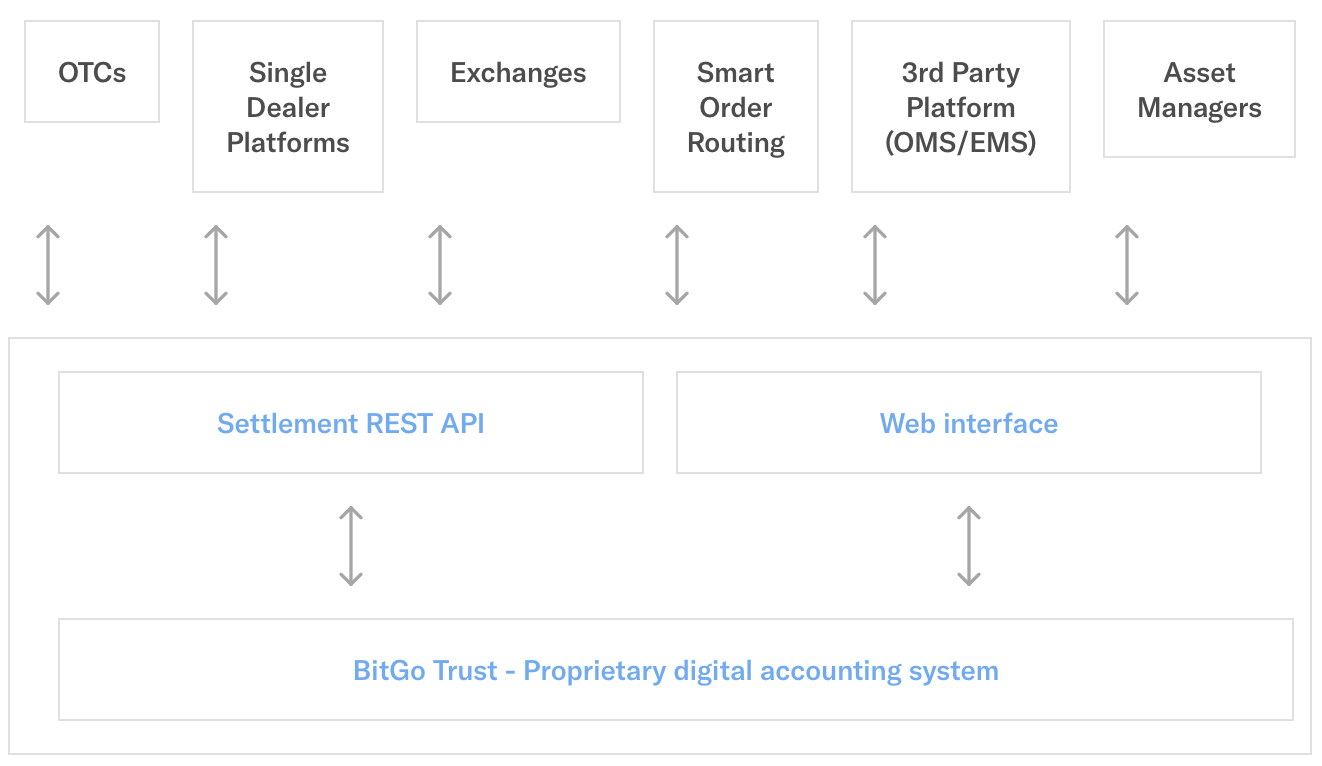

Having onboarded and secured funds from OTC desks, exchanges, hedge funds, broker-dealers, lenders, payment processors, and security token issuers under the regulated entity BitGo Trust Company, participants can choose their counterparties and check trading limit pre-trade, and customize fund-locking options like limit and duration.